James Bond to have a new owner within a week as MGM buy-out is imminent

09-Sep-2004 • Bond News

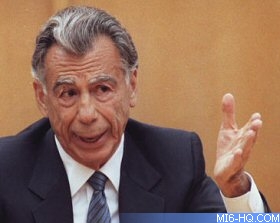

Above: MGM majority share holder Kirk Kerkorian.

Time Warner CEO Dick Parsons has revamped his previous stock offer and now is offering $4.6 billion in cash for MGM, according to both sources - reports USA Today.

Sony Corp. of America CEO Sir Howard Stringer is offering more money â $4.8 billion in cash â according to a source familiar with the bid. But Sony's offer also is more complicated. The media giant is bidding for MGM through a consortium that includes the financial backing of private equity firms Providence Equity Partners and Texas Pacific Group.

The 87-year-old Kerkorian is leaning toward Parsons' cleaner bid, according to both sources.

That offer is favored by analysts to win the biggest Tinseltown bidding war since NBC got Vivendi Universal Entertainment last year.

"Time Warner looks to be in the driver's seat. Their bid is less than Sony's, but it's a ready cash bid," says financial analyst Peter Mirsky of Oppenheimer & Co.

Representatives of MGM, Time Warner and Sony declined to comment on the negotiations.

The bids are less than the $5 billion Kerkorian was reportedly asking, but the company said last week that press reports "valuing MGM at a price as high as $5 billion are inaccurate."

Time Warner's bid involving a stock issue was complicated by an ongoing federal probe of AOL accounting. But it also might have decided it's better to pay Kerkorian and be done, than make him a major Time Warner shareholder, writes analyst Jessica Reif Cohen in a research note for Merrill Lynch. He can be an "active, non-conformist investor," she writes.

Just ask DaimlerChrysler, which has been battling a $3 billion lawsuit by Kerkorian's Tracinda company since 2000. Kerkorian, who once tried to take over Chrysler himself, alleges he was misled that the 1998 merger of Daimler-Benz and Chrysler would be a merger of equals. DaimlerChrysler says his lawsuit is without merit.

"Time Warner does not want Kirk Kerkorian in there screwing around," says Mirsky, noting the company already has one cantankerous billionaire shareholder in Ted Turner. "Time Warner is more familiar than it cares to be with having large shareholders who like to stir up trouble."

The deal would mark the third time in 25 years Kerkorian has bought and sold the movie studio behind the popular James Bond and Pink Panther film franchises. MGM's major asset is a lucrative library of more than 4,000 films, including 15 Best Picture Oscar winners such as West Side Story.

Since first buying a controlling stake in MGM from Edgar Bronfman Sr. for $82 million in 1969, Kerkorian has sold MGM twice: to Turner, for $1.5 billion in 1986; and Italian mogul Carlo Paretti, for $1.4 billion in 1990. He bought the studio back twice at bargain prices.

Thanks to `JP` for the alert.

Discuss this news here...

Discuss this news here...